The Expert’s Portfolio

As of June 1, 2023

Number of Positions: 3

Total Invested to Date: $3,000.0

Current Portfolio Value: $2,815.3

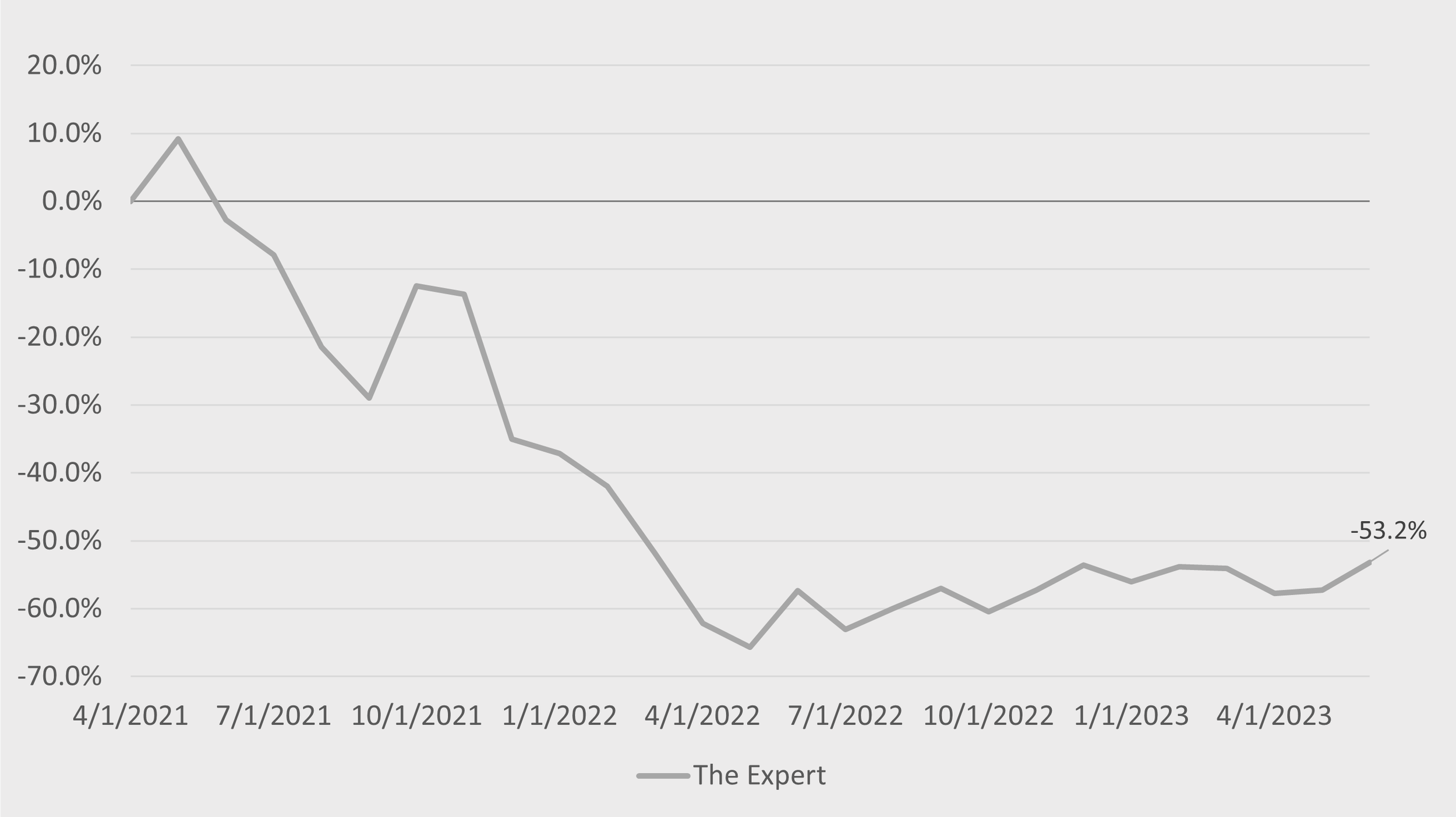

The Expert CAGR: -29.5%

The Value CAGR: 11.2% (see portfolio)

The Oracle CAGR: -27.1% (see portfolio)

Peacock CAGR: -11.8% (see portfolio)

Annual Returns

Peacock

2021: -19.6%

2022: -11.4%

2023: +6.8%

The Value

2021: +20.1%

2022: -0.3%

2023: +5.2%

The Expert

2021: -62.1%

2022: +11.5%

2023: +11.0%

The Oracle

2021: -16.8%

2022: -41.9%

2023: +4.3%

S&P 500

2021: +13.1%

2022: -9.6%

2023: +2.7%

Russell 2000

2021: -7.2%

2022: -13.8%

2023: -1.9%

Nasdaq

2021: +5.8%

2022: -14.3%

2023: +7.2%

Portfolio Positions and Current Allocations

Portfolio Return

Portfolio Return vs. Indices

Portfolio Return vs. Other Portfolios

CAGRs

Start Date: 4/1/2021

End Date: 6/1/2023

Peacock CAGR: -11.8%

S&P 500 CAGR: 2.3%

Russell 2000 CAGR: -10.6%

Nasdaq CAGR: -1.3%

The Value CAGR: 11.2%

The Expert CAGR: -29.5%

The Oracle CAGR: -27.1%

Individual Stocks

As of June 1, 2023

Angi Inc. (NASDAQ:ANGI)

Pitched By: The Expert

Purchase Date: 4/1/2021

Purchase Price / Value: $14.66 per share / $1,000.0

Current Price / Value: $3.19 per share / $217.6

CAGR: -50.5%

Element Fleet Management Corp. (OTCPK:ELEE.F)

Pitched By: The Expert

Purchase Date: 4/1/2022

Purchase Price / Value: $9.47 per share / $1,000.0

Current Price / Value: $15.15 per share / $1,600.0

CAGR: 49.6%

Waste Management, Inc. (NYSE:WM)

Pitched By: The Expert

Purchase Date: 4/1/2023

Purchase Price / Value: $163.17 per share / $1,000.0

Current Price / Value: $162.80 per share / $997.7

CAGR: -1.4%